Have you been thinking about building an app and doing it yourself? This guide is for you.

I’ve been a software engineer for 20+ years. Throughout my career, I’ve built five different startups. When I first started as an app developer, there were only two choices—Java and Objective-C.

Basically, you had two options with these. You could build your own app for Android with one and iOS for the other. That’s it.

But today, there are a lot more options out there that you can explore if you want to learn how to make an app. These ways range from very technical to not that technical at all.

I created this guide to show you the five different ways to build an app from scratch.

But before we dive in, I just want to take a moment to explain how I categorized these five different methods to create your own app.

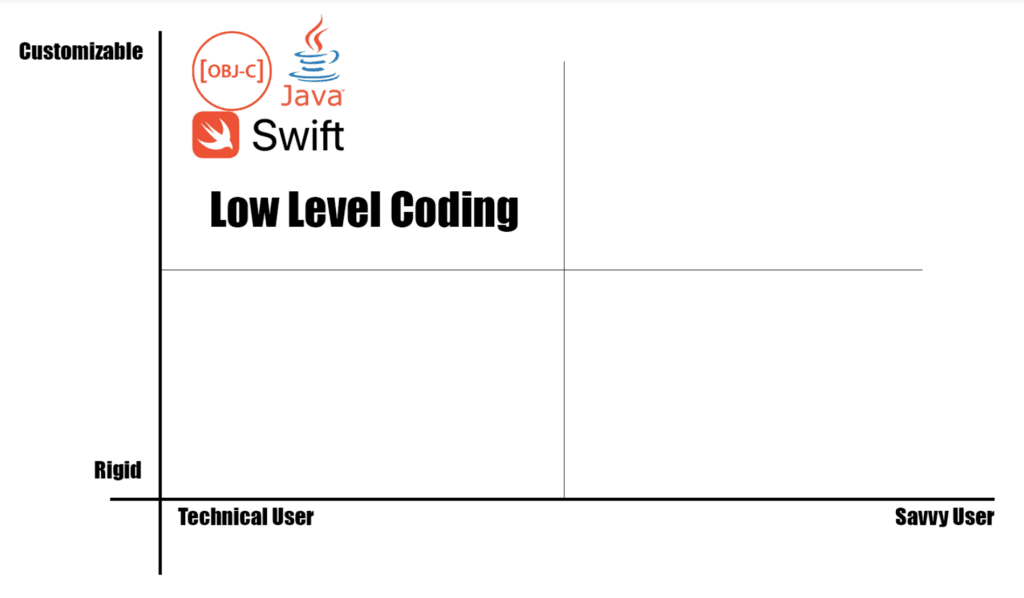

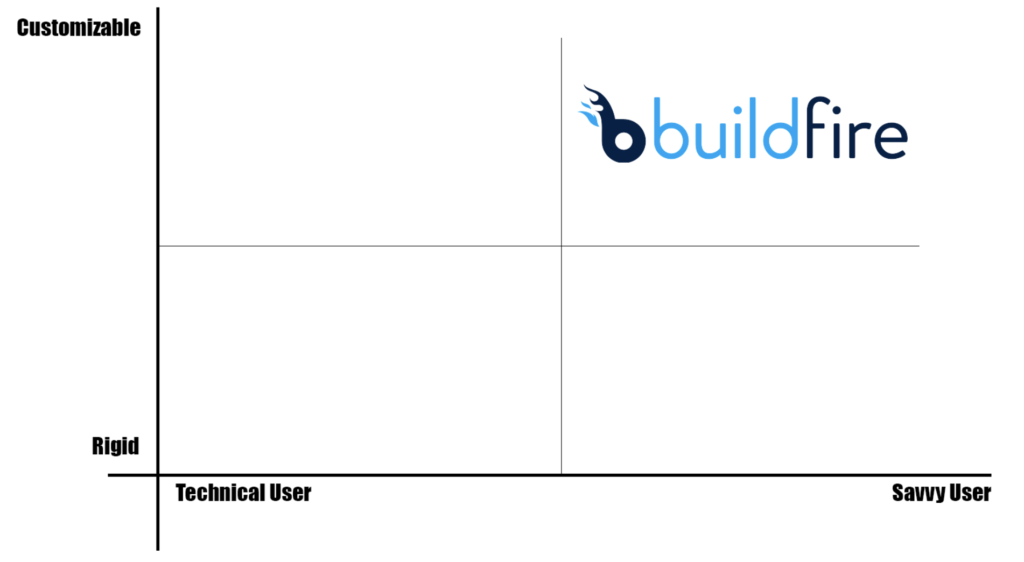

One of the metrics I used was how technical you need to be in order to create an app. One end of the spectrum is a hardcore developer, and the other end is someone who is just savvy and knows how to use the Internet. The other metric I used was how flexible or rigid the solution would be for how to make an app.

For example, you could have an app development tool that’s extremely flexible; however, you need to be very technical in order to use it. Or you could have a tool that you don’t need to know how to code at all, but there might be some limitations on what you can do with it.

I’ll show you a graph with both of these metrics for each way to make an app. This will give you a visual representation of where the method falls on the spectrum. Let’s dive in!

Mobile App Development Method #1: Low-Level Coding

With low-level coding, the difficulty is pretty high. To make an app using this method, you need to be a specialized developer that understands programming languages.

But the flexibility is very high with low-level coding as well.

So there are definitely pros and cons to this option.

For the majority of the population, the biggest downside is that you have to be a developer to create an app from scratch with low-level coding—and a pretty good developer at that.

But the good side here is that the flexibility is at a maximum.

This is the best option if you’re trying to develop an augmented reality app or a game where the frame rate down to the millisecond is extremely important. Low-level coding is so flexible. Another good reason to use this method is if you’re dealing with specific hardware on a device that’s not mainstream.

Low-level coding will be the most time consuming app development process and the most expensive way to build an app, but you get the most control out of it.

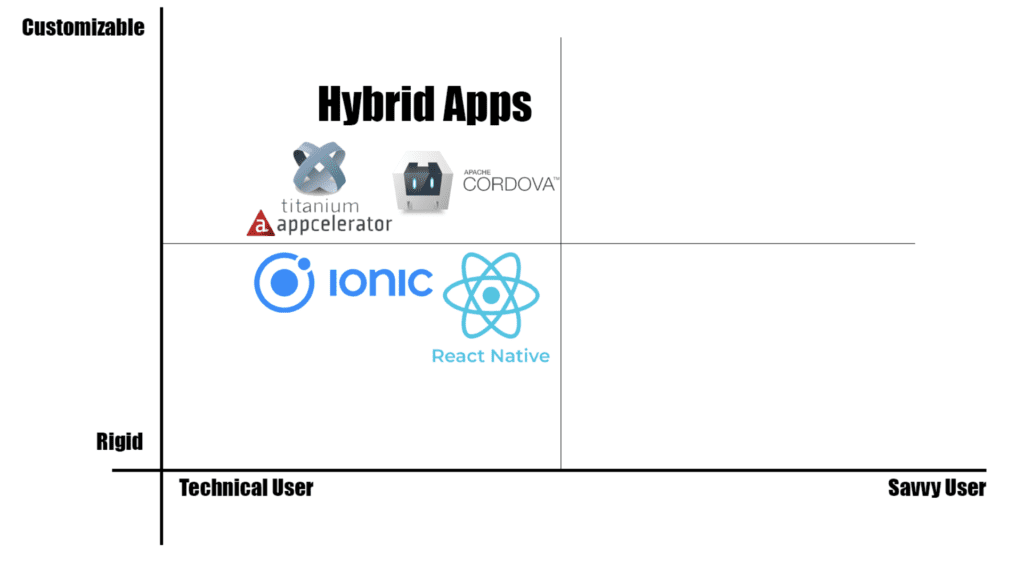

Mobile App Development Method #2: Hybrid Apps

Hybrid app development usually relies on web technology, called Javascript.

This allows you to build once and deploy it on multiple platforms. So if you’re learning how to make a hybrid app, you’ll just code everything one time, and it will work on both iOS, Android, and potentially other platforms as well.

Examples of hybrid app development tools include Titanium from Appcelerator, Cordova on PhoneGap, Ionic, and React Native.

This method is really good when you want one set of developers, and you want to just develop everything once—then go straight to market with iOS and Android.

The difficulty here is low to medium. You don’t have to be as specialized as a developer like you would with low-level coding. Web developers can build hybrid apps because they know Javascript.

The flexibility level here is still very flexible. Here’s where hybrid apps fall on our graph:

Since you’re using Javascript to run the app, there will be a small performance hit that you need to take into consideration.

However, with today’s hardware and Internet speeds, that performance metric is shrinking dramatically. There are very popular hybrid apps out there that are UI intensive. One example is PBS Kids, which was made on Cordova. It performs extremely well.

You’ll just want to make sure that you reassess these metrics every couple of years. The dynamics of phones and network speeds will be different over time.

But as much as everyone used to learn how to make an app with low-level coding in the beginning, they are leaning more towards hybrid apps now. The main reason for doing so is the business side of app development. You can save a lot of time and money going hybrid vs. fully native development.

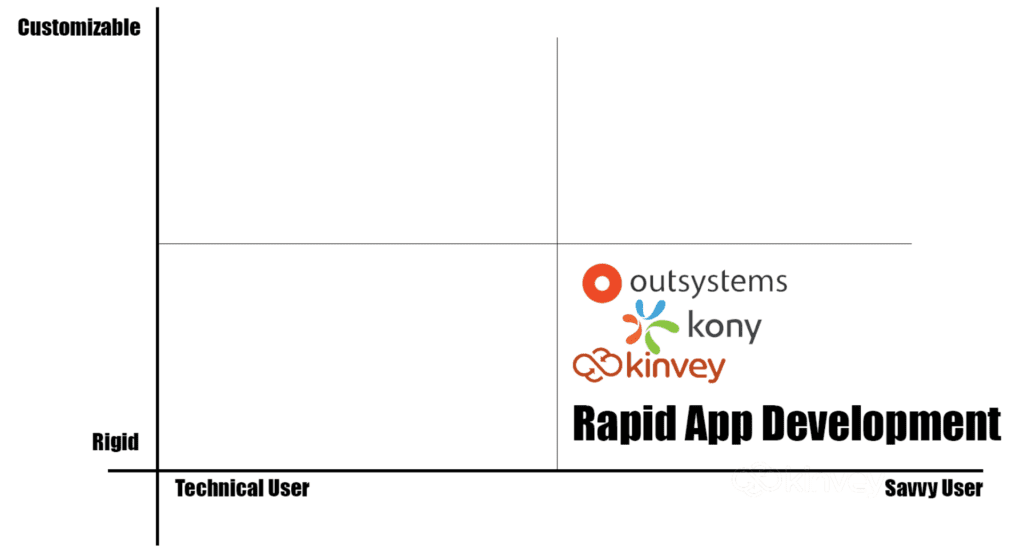

Mobile App Development Method #3: Rapid App Development (RAD)

The third way to create an app is with rapid app development tools—RAD for short.

There are RAD tools out there like OutSystems, Kinvey, and Kony. These allow you to make a mobile application using an intuitive interface.

Usually, rapid app development platforms claim that you don’t have to be too technical at all to use them.

However, if you want to do anything significant with your project, you sort of have to lean toward technical. You won’t have to be as technical as you would to create a hybrid app. But it’s around the medium level.

Here’s what I mean. You’ll have to know what you’re doing from a technical perspective, but you won’t have to learn how to code everything from scratch to build on these platforms.

So essentially, rapid app development allows you to go to market faster (hence the name) because there is a lot of pre-built functionality.

There are some drawbacks to rapid app development as well. Aside from the need to be somewhat technical in order to do anything significant, you’re also limited by the platform you’re using. You can only use whatever that platform has to offer in terms of functionality.

You’ll just be configuring their tools and options in a way that works for you.

These are great if you’re building apps internally for some type of internal process or maybe an app for your employees. It’s fine to use RAD if you don’t mind maintaining it yourself or paying someone to maintain it for you.

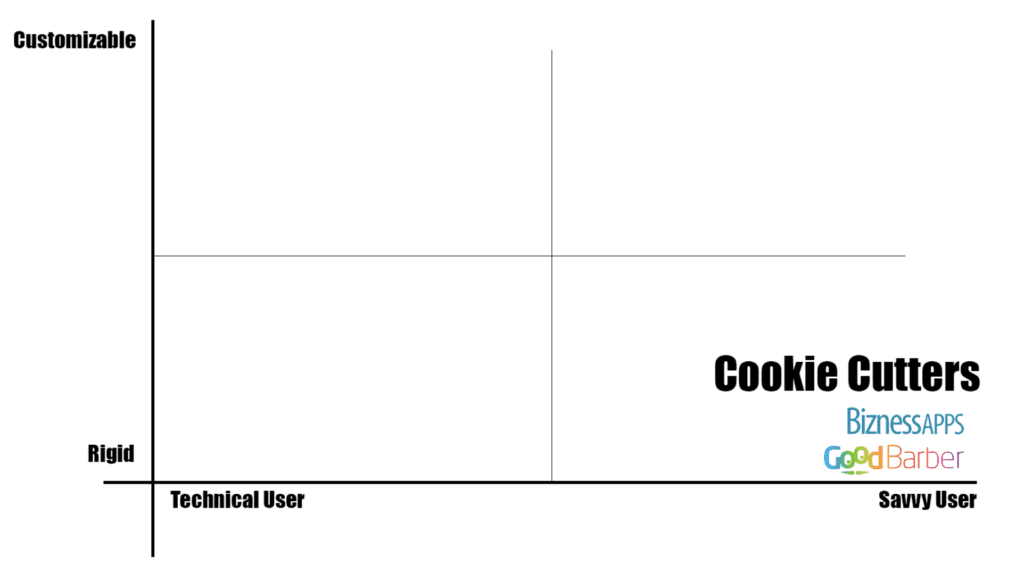

Mobile App Development Method #4: Cookie Cutter Apps

What’s a cookie cutter app? You might be familiar with some of these tools that are on the market today. A couple of popular ones include BiznessApps and GoodBarber.

With cookie cutter app builders, it’s really just one app that you’re configuring to make it look different from one deployment to another. What do I mean by this?

Cookie cutter app builders usually have a beautify app design. They have a highly intuitive user interface. You can turn settings on and off in the app to configure the app on your own. They make it easy for you to swap out images and text with your own content.

But at its core, a cookie cutter app is really just one set of functionality on a template that you’re turning on and off to make the app your own. So you can’t really take an app idea to the next level.

The difficulty level is pretty low here. Unfortunately, the flexibility is pretty low too.

This is a good option if your app is just a hobby. Or maybe you want to learn how to make an app for something that’s just “nice to have” as opposed to something that’s critical to your business. The user experience will ultimately suffer with the limited functionality.

If you just want to get to market quickly with an MVP and keep your budget really low, this is a good solution. You’ll be able to maintain everything yourself too.

However, the downside of using this app development method is that you’re probably going to reach a ceiling at some point when it comes to the functionality of your app.

There are certain things that you’ll eventually want to do, and the platform just won’t allow it. You’ll basically be waiting for the platform to catch up to your needs.

So if you don’t see your mobile app growing to the point where you’ll outgrow the platform, then these cookie cutter apps could be a good solution for your situation.

Mobile App Development Method #5: BuildFire

BuildFire is in a quadrant of its own.

As the CTO and a partner at BuildFire, I’m obviously a little biased here. I know the platform really well. But I still want to be honest and give you the pros and cons.

My partners and I built this app builder because we recognized that this quadrant was completely empty, and nobody was addressing it. We saw the need and built a solution.

BuildFire allows people with no technical skills to build for iOS apps and Android apps using our extensive marketplace that has a plethora of features that can be added in.

It’s also open to the app developer community, so they are constantly adding in more features.

Here’s one of the major differences between BuildFire and other app development platforms on the market today. If you feel that there’s a unique functionality to you and your app or a piece of functionality that hasn’t been developed yet, you can get your own developers to create it using the BuildFire SDK. They can build the functionality in a way that’s similar to hybrid apps without limiting your app ideas.

You can also use BuildFire to access native device APIs like bluetooth, ibeacon, cameras, and more.

Alternatively, you can contact BuildFire and take advantage of its white-glove services. The BuildFire developers can create this custom functionality for you.

As I already mentioned, I’m obviously a little biased here. But in the spirit of being fair, I’ll explain situations when BuildFire would not be the best solution for creating a mobile app.

If you’re trying to make an augmented reality app, BuildFire probably isn’t for you, at least right now. That might change in the coming years.

If you’re trying to create a first-person shooter game or develop the next Angry Birds, this won’t be the most ideal solution for you either.

Could you do it? Absolutely. I’m not saying that the capabilities aren’t there. But professionally speaking, you’re better off going with low-level development and using Swift or Java to build your app in those scenarios.

However, everybody else out there who wants to go to market quickly and wants the platform to scale with their needs, BuildFire is an extremely powerful platform.

BuildFire allows you to utilize the app building portion as well as the backend infrastructure. So you can reduce your ongoing development costs dramatically.

Once complete, you can launch your app on the Apple App Store and Google Play Store simultaneously with the help of BuildFire’s team. These native apps can be downloaded by real users worldwide with Apple iPhones and Android devices.

BuildFire’s pricing is very affordable too. The platform has been used to create 10,000+ apps, including apps for small businesses.

What’s the Best Way to Make a Mobile App?

Now that we’ve gone through the five different app development methods, it’s time to answer everyone’s burning question—which one is the best for a new app?

Realistically speaking, there is no one right answer here. The method you choose depends on your specific needs. The best way to create an app for me might not be the best way for you or your business.

It all depends on your technical skill level and how much flexibility you need to have. Here’s a quick recap of the five methods we discussed above:

Low Level Coding — Extremely technical but highly flexible. This app development method is costly and time consuming, but you can do just about anything with it.

Hybrid App Development — You develop the app once and deploy it to many platforms using technology like Javascript. It’s still pretty technical, but your flexibility is a bit lower compared to low-level coding.

It’s good for people who really want control of their platform and don’t want to outsource everything. With hybrid apps, you can bring everything in-house and not necessarily utilize a particular service out there.

Rapid App Development (RAD) — Great option for those of you who don’t mind rolling up your sleeves and getting to work. It’s not too technical, but you can’t be afraid to dig in a little bit and do some work to manage it yourself.

RAD is a good solution for internal uses in cases when you’re not worried too much about UI, performance, and things of that nature. It could get pricey, depending on the platform you’re using. But those platforms will likely have an infrastructure that will aid you and a service layer that can build things for you.

Cookie Cutter Apps — These app makers are a really good solution if the app is just a hobby, and you’re trying to keep your budget as low as possible. Not recommended for apps that are mission critical to your business. If you just want to get an app out there quickly and you’re not worried about functionality, cookie cutters are usually beautiful and cheap.

BuildFire — This method allows you to create an app from scratch with no technical skills whatsoever. Even if you have technical skills, you can use BuildFire to do whatever you want with your app with limitless customization. Alternatively, you have BuildFire developers build something for you.

It also has a backend infrastructure that you can utilize. This solution ensures that you won’t have to deal with database servers, security, compliance, and things of that nature. BuildFire takes care of all of that for you.

BuildFire is the best option for people who really want to hit the ground running. The platform will save you time and money. You won’t be boxed into a platform when your needs grow. It’s great because it allows your developers or their internal developers to expand the app to make anything you want.

Conclusion

Want to learn how to make an app? Before you get started, you need to choose the best app development method. There are five main options to consider.

Choose the method that fits your technical skill level and needs of your app. It all depends on how flexible you need the solution to be and how technical you are. An app building platform will be the best option for most of you.

I hope this guide clearly explained all of the app development options. You can use it to choose what’s right for you and your business.

If you have any other questions, feel free to reach out and let me know. Good luck!